BaaS Compliance Solutions

Full Compliance for BaaS Platforms. One platform. White-label. Regulator-ready.

Upgrade outdated compliance systems with one platform — automate onboarding, monitoring, and reporting without replacing your core.

WE ARE TRUSTED BY

We partner with industry leaders in compliance, identity verification, and transaction monitoring to deliver seamless, secure, and innovative solutions for modern businesses

Compliance Built For Embedded Finance

Scenarios where A.ID helps BaaS providers deliver secure, regulator-ready services at scale.

01

Partner Onboarding

Problem

Onboarding fintech partners across multiple regions is complex, with different KYB standards and regulatory expectations. Manual checks slow the process, increase costs, and expose providers to compliance risks.

Solution

A.ID automates KYB flows with registry checks and EDD workflows, standardizing partner reviews across jurisdictions. This ensures smooth integrations, faster onboarding, and regulator-ready documentation.

02

White-Label Compliance

Problem

Fintech partners expect fully branded user experiences, while regulators demand strict verification and record-keeping standards. Balancing both often requires heavy customization that legacy tools cannot support.

Solution

A.ID delivers white-label onboarding flows, custom PDFs, and branded notifications that satisfy client needs. At the same time, compliance processes remain fully auditable and regulator-approved.

03

API-First Integrations

Problem

Legacy compliance tools often break embedded finance flows, require duplicate data entry, and slow deployment timelines. This prevents BaaS providers from offering seamless, scalable services to fintech clients.

Solution

A.ID provides modular APIs and SDKs that integrate compliance directly into financial products. Compliance becomes part of the user experience instead of a barrier to launch.

04

Ongoing Monitoring

Problem

Monitoring activity across multiple fintech clients creates operational strain, with large volumes of alerts and regulatory checks. Teams are forced to manage fragmented systems and inconsistent data.

Solution

A.ID centralizes transaction monitoring, screenings, and periodic reviews in one dashboard. This reduces workload, ensures consistency, and keeps every partner regulator-ready.

The Essentials to Launch Smarter

Out-of-the-box modules that cover onboarding, checks, and reporting — with room to expand later.

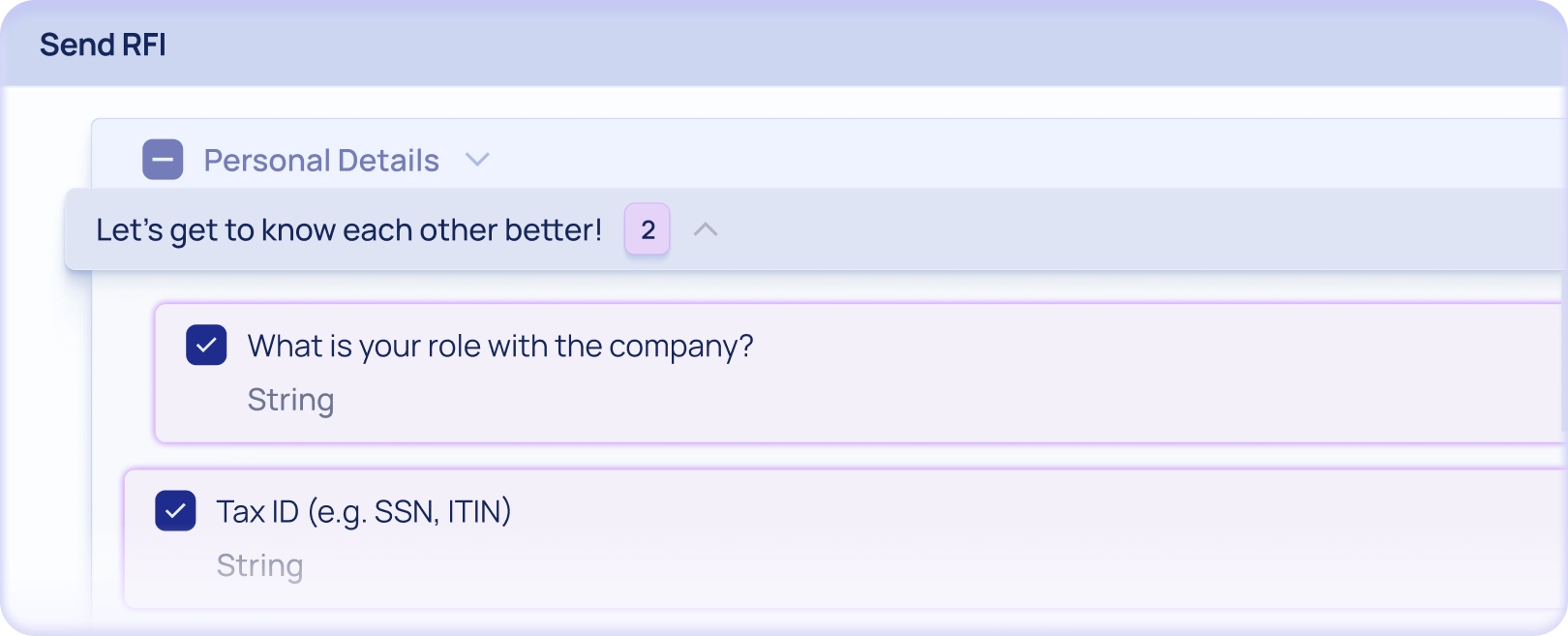

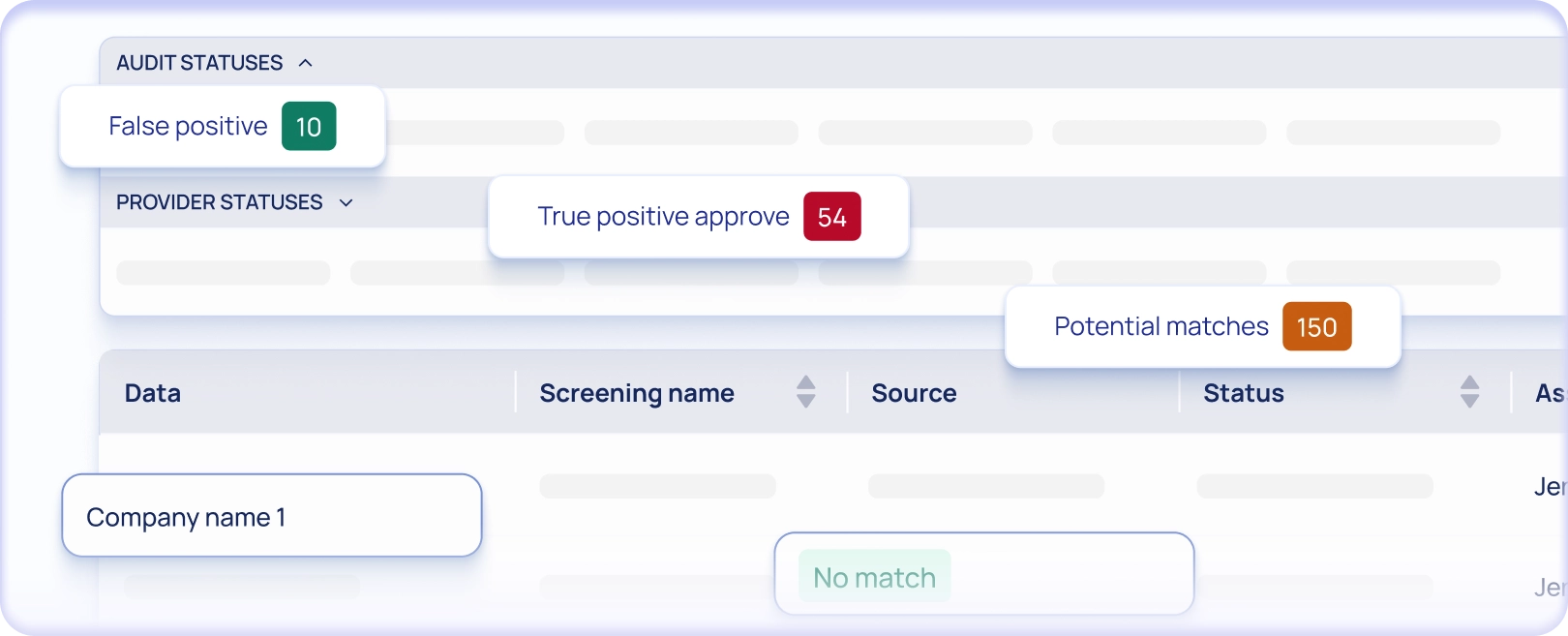

Case Management & RFI

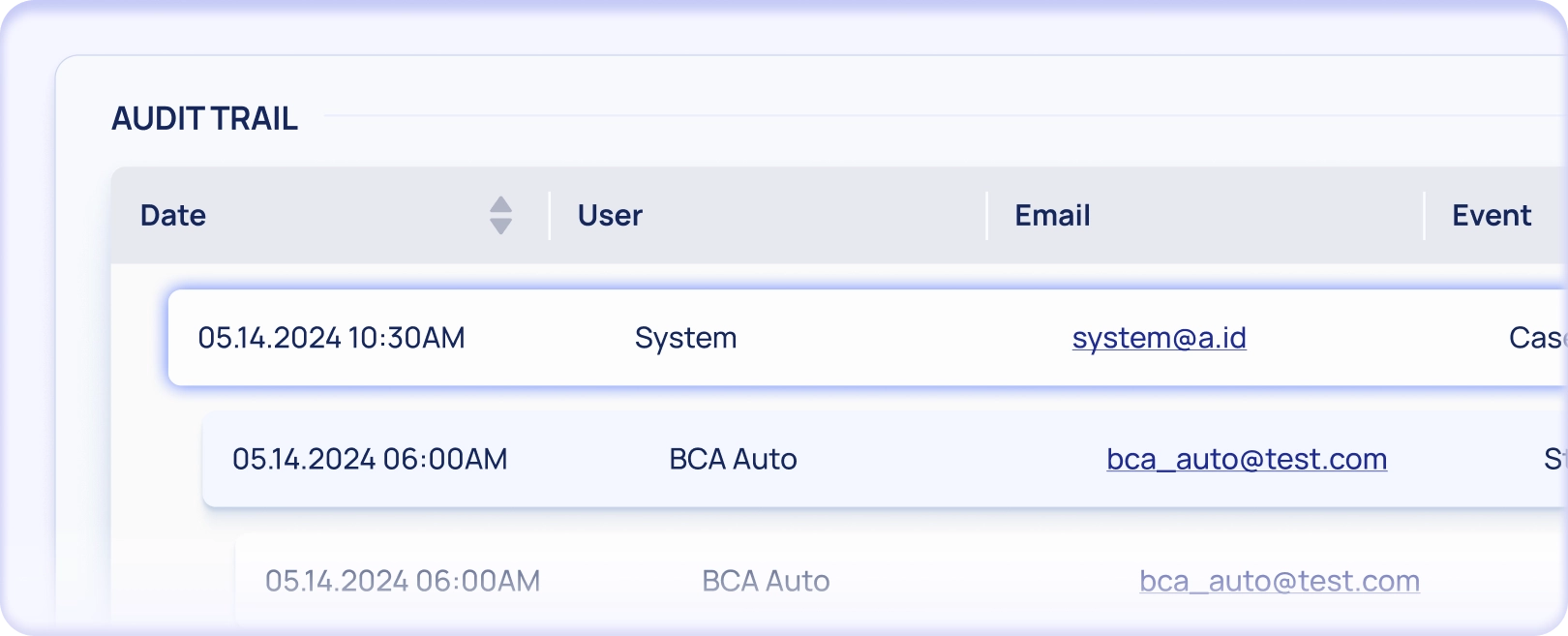

Centralized case handling allows compliance officers to review, annotate, and escalate efficiently. Built-in RFI tools let you request missing information from clients with full audit tracking.

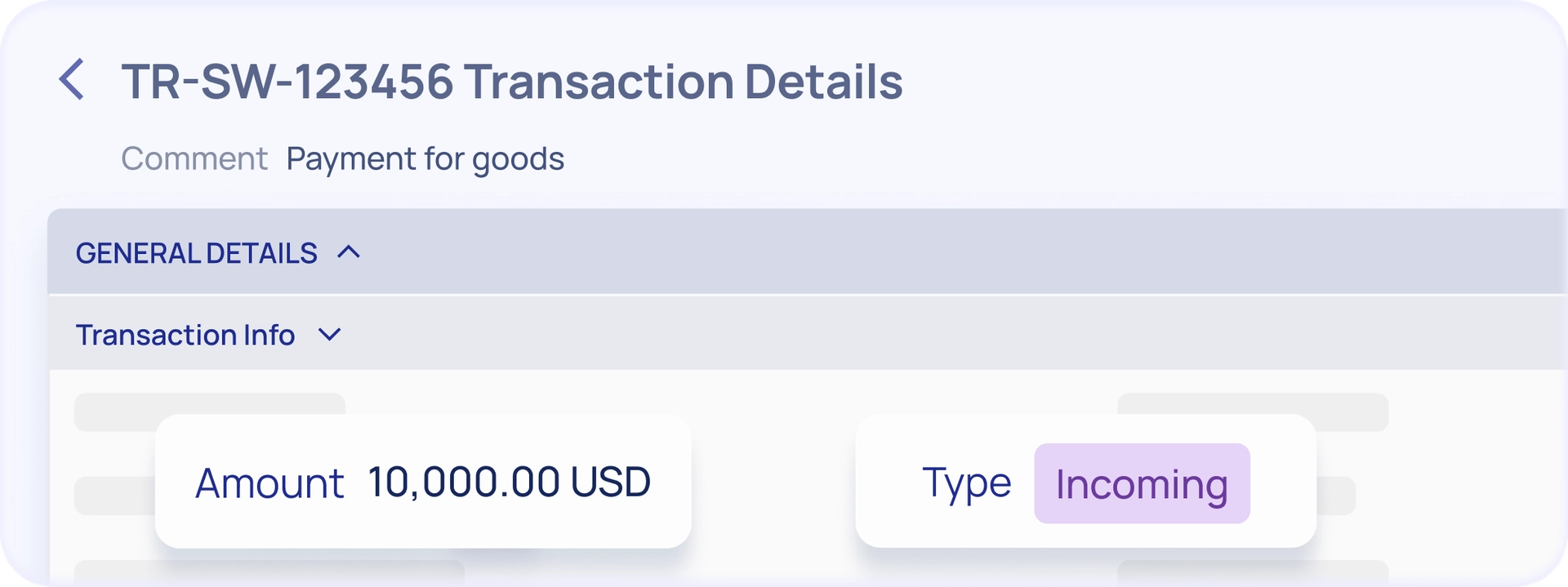

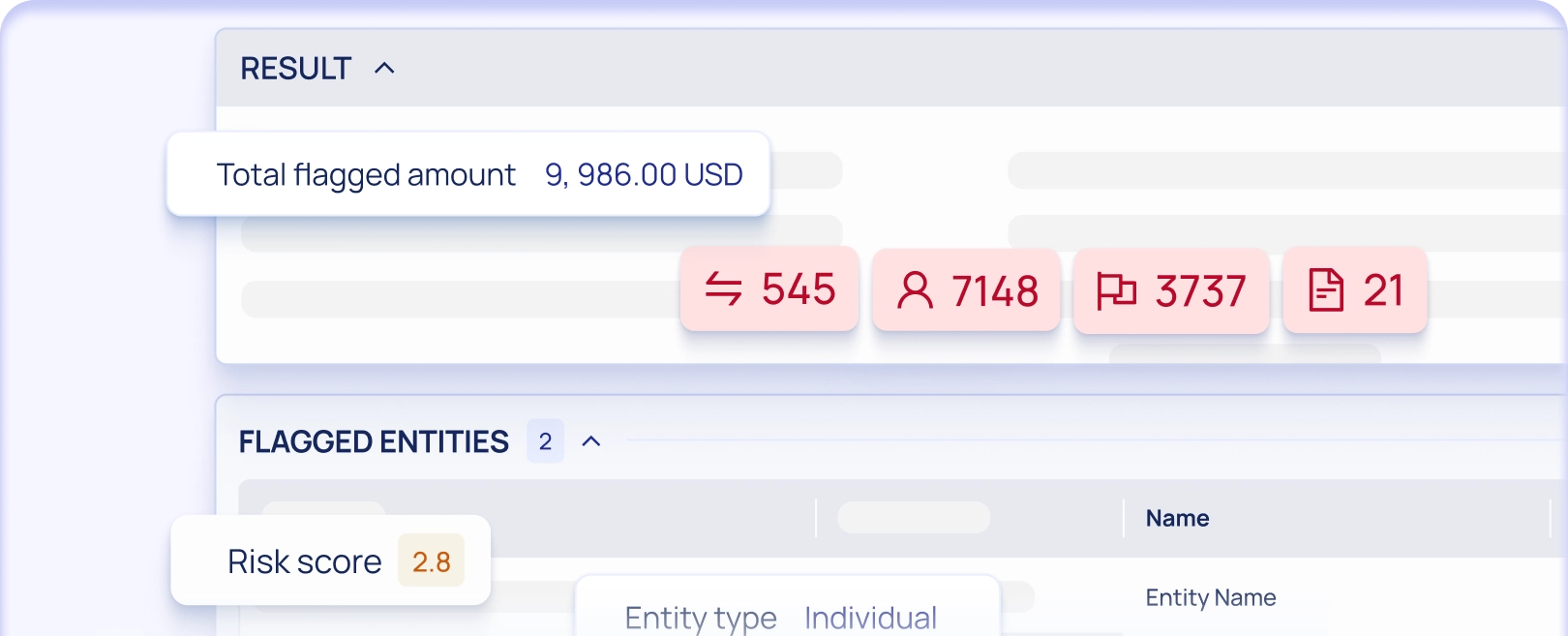

Transaction Monitoring

Monitor, analyze, and act on financial activity — in real time. A.ID’s transaction monitoring module empowers your compliance team with a fully integrated, rule-driven system that detects risk before it becomes exposure.

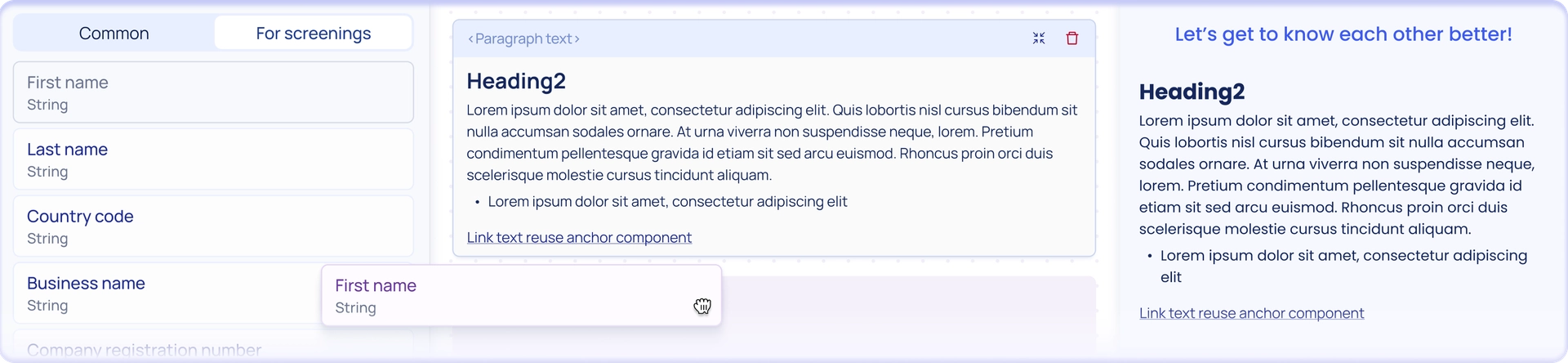

Digital Onboarding and Form Builder

Configurable, no-code forms tailored for individuals or businesses, with conditional logic that adapts to client type and jurisdiction. Built-in document upload and validation streamline data collection and reduce friction in onboarding.

Risk Scoring Rules

Define simple scoring logic based on risk indicators like geography, client type, or verification outcomes. Automated actions from RFI triggers to case escalation — ensure consistency and reduce manual oversight.

Compliance Status Model

Clients are assigned managed statuses (Approved, Pending, Review, etc.) that update automatically with new verification results. Alerts are generated when IDs expire or new screenings affect an existing client.

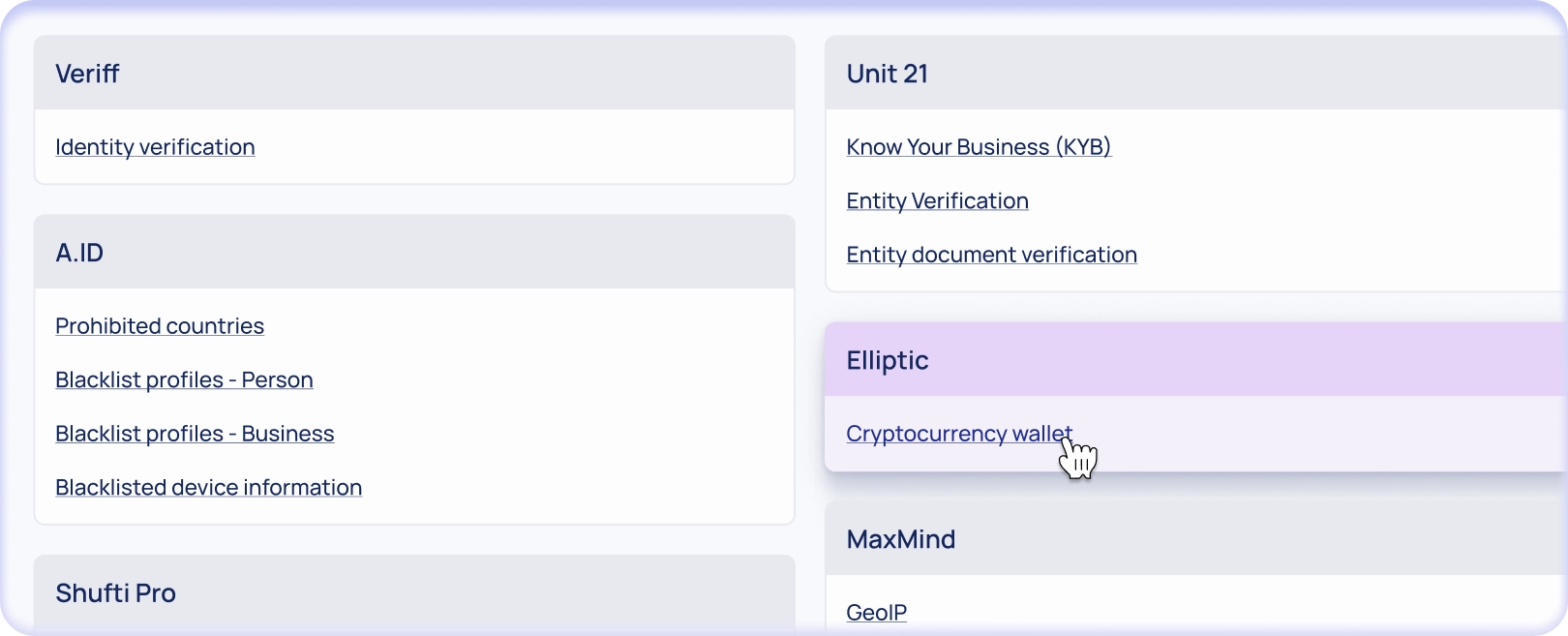

External Data Verifications

Manually select verification providers for sanctions/PEP, adverse media, and corporate registries based on your risk model. This flexibility helps optimize cost while ensuring that each case gets the right level of scrutiny.

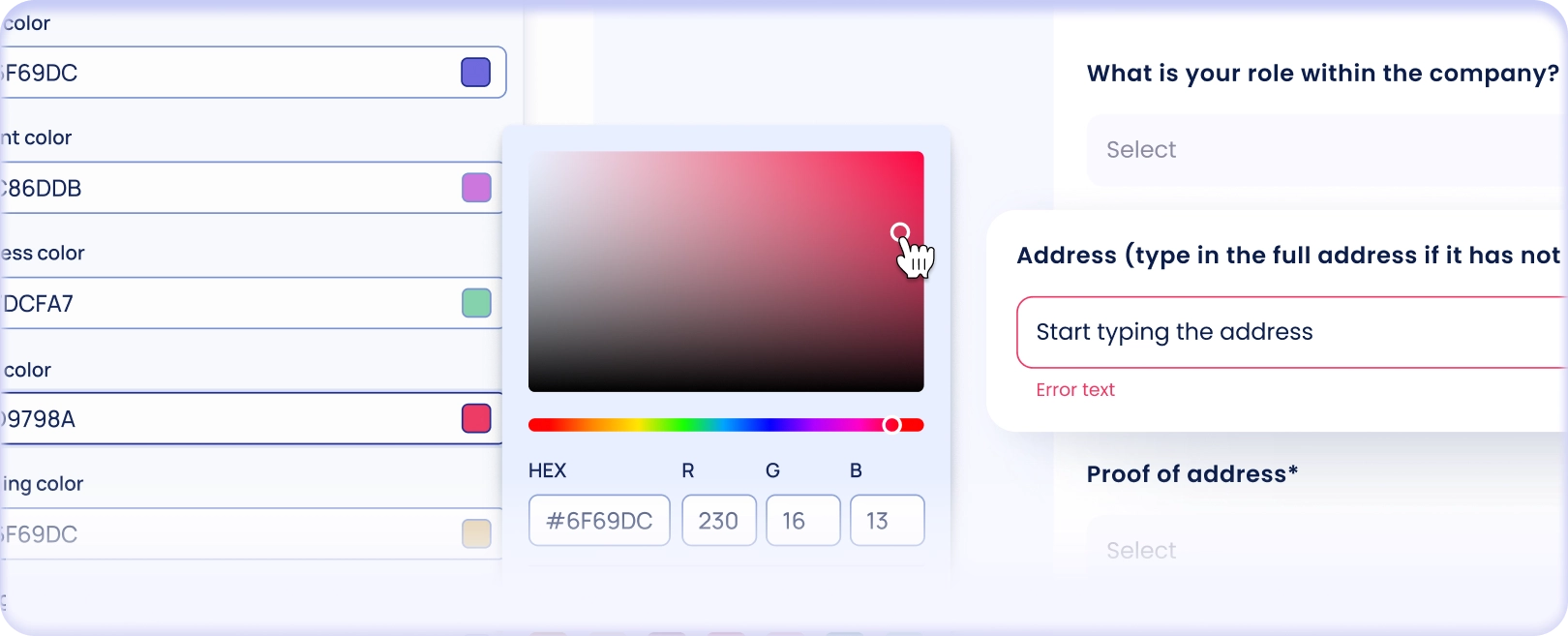

White-Label & IFrame Embeds

Launch branded onboarding flows directly in your product with IFrame embeds and styling options. Carry the same white-label experience into PDFs and emails — ensuring consistency, trust, and compliance across all client touchpoints.

Security & Governance

Enterprise-grade security with SOC 2 certification, role-based access, and encrypted infrastructure. Comprehensive audit logs, data residency, and retention controls ensure you stay regulator-ready.

AI Assistance

Automatically summarize submitted forms and docs into clear, actionable overviews. AI flags missing, suspicious, or inconsistent data, and provides a chat assistant for both case-specific and system-wide queries.

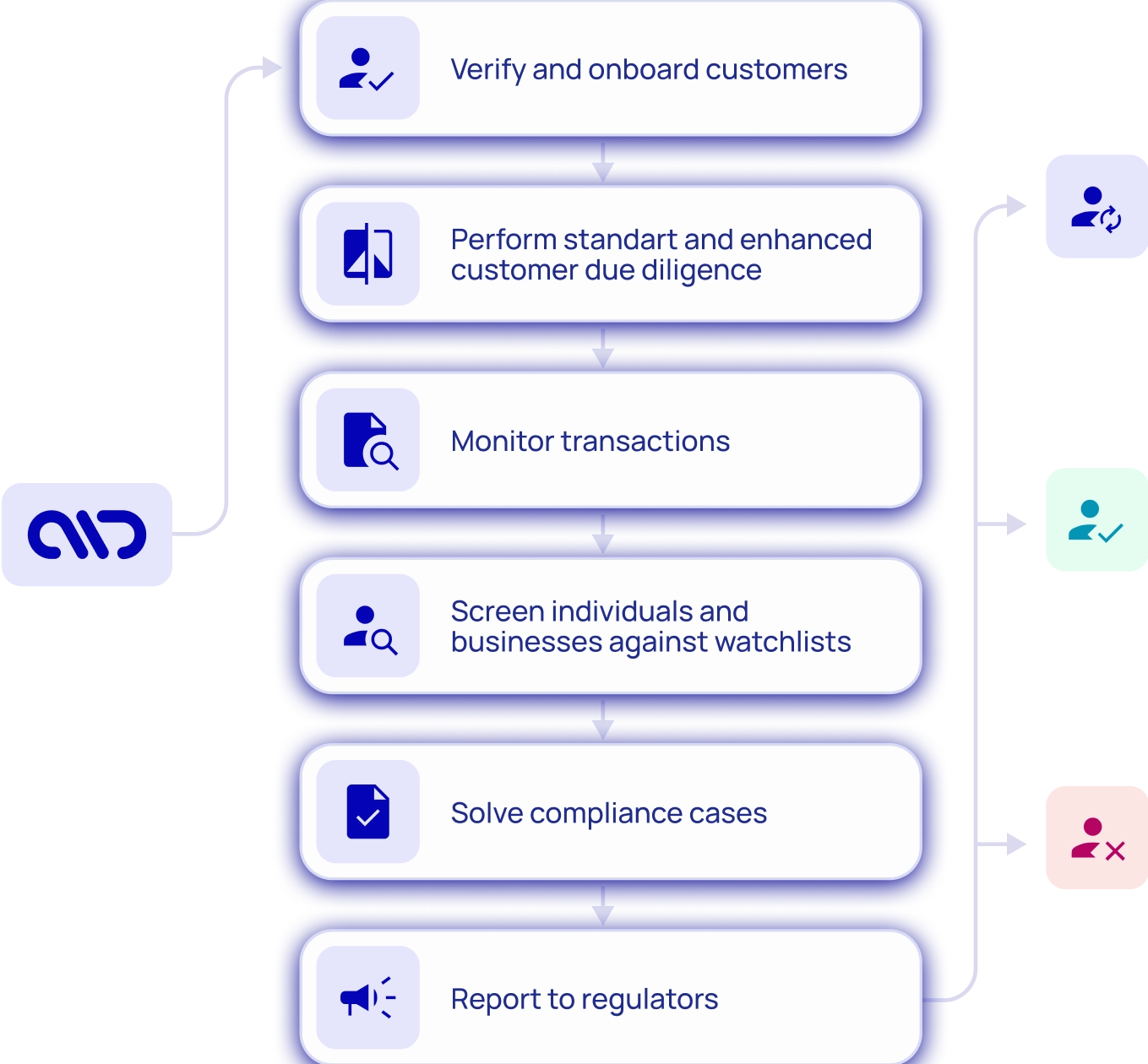

The ideal compliance flow for every partner

KYC and KYB requirements differ across regions and partner types, creating complexity for BaaS providers.With A.ID Compliance-as-a-Service you can standardize and customize these flows — streamlining identity checks, data validation, and document collection for each fintech partner while ensuring full compliance and fraud prevention.

All delivered through a single integration that scales with your platform.

Enable Growth Without Compliance Bottlenecks

A.ID helps BaaS providers keep partners happy and regulators satisfied.

BaaS platforms operate in a high-pressure environment where speed, scale, and compliance must coexist. A.ID provides the infrastructure to manage risk, simplify workflows, and build regulator trust without slowing down innovation.

Faster Onboarding

Prebuilt forms, workflows, and KYB modules accelerate fintech integrations, cutting delays and creating faster, smoother revenue streams.

Lower OPS Costs

AI-powered summaries and automated case handling reduce repetitive tasks, lowering expenses while boosting overall compliance team productivity.

Regulator Confidence

Instant audit-ready reports and immutable logs provide transparency across every partner flow, ensuring stronger trust with regulators.

Scalable Compliance

Add providers, expand into new jurisdictions, and scale monitoring seamlessly as your ecosystem grows without added complexity.

Bank-Grade Security For BaaS Providers

SOC 2 certified, encrypted, and continuously monitored — built for multi-tenant platforms.

SOC 2 Type II Certified

Independent audits confirm A.ID meets strict security and data integrity standards.

Continuous Monitoring

Automated checks detect anomalies in real time to strengthen resilience.

End-to-End Encryption

Client data is protected in transit and at rest with AES-256 encryption.

Independent Penetration Tests

Regular third-party testing identifies and fixes vulnerabilities proactively.

Role-Based Access Control

Granular controls ensure only authorized staff access sensitive information.

Immutable Audit Trails

Every action is recorded in tamper-proof logs for transparency and review.

Start using today

Start instantly

No integration required to start using our services

Just paste a link

Start from simply pasting a shortlink to your own app

Flexible branding

Extensive whitelabel options to match your style

Easy API

Easy API integration available for complex apps

A.ID Europe UAB | Savanoriu avenue 6, Vilnius, LT-03116, Lithuania

© 2025 A.ID Europe UAB. All rights reserved